How To Define Your Salary Increase Budget

When it comes to talent attraction and retention, compensation is pretty much the most important tool in your belt.

Sure, things like company culture, employee recognition and engagement are important too — but they won’t get you very far if your salaries aren’t fair and competitive.

And the only way to make sure that’s the case is by reviewing and adjusting them regularly. That’s why your annual compensation review is such an important moment in the year.

One of the most important parts of the compensation review process is defining what your budget will be. And exactly what this process looks like is different for every organisation, because it should be underpinned by your overall compensation philosophy.

That said, there are some guidelines and common practices that most companies abide by — read on to learn more.

Psst! This post is an edited excerpt from our recent report, Compensation Reviews in the Era of Pay Transparency. In it, we share insights from our latest compensation review survey, plus tips on running compensation reviews that comply with the EU pay transparency directive. Download the full guide here!

Defining your salary increase budget

Figuring out your salary increase budget is not a quick process. There are a lot of different components to consider — which we’ll get to in a minute. The process also typically involves a lot of different people. For example, you might need input from:

- Your CEO and senior leadership team

- Your CFO and finance team

- Your HR and people team

While the ultimate ‘owner’ of your budget might depend on your organisation’s structure and way of operating, it’s a good idea to get input from all of these parties, as they all have their own ideas and perspectives to bring to the table.

For example, your CEO is best placed to provide insights into your company’s overall strategy. Finance brings an understanding of its financial position, and HR holds data on your employees and the external market.

{{cta}}

Structuring your salary increase budget: 4 things to consider

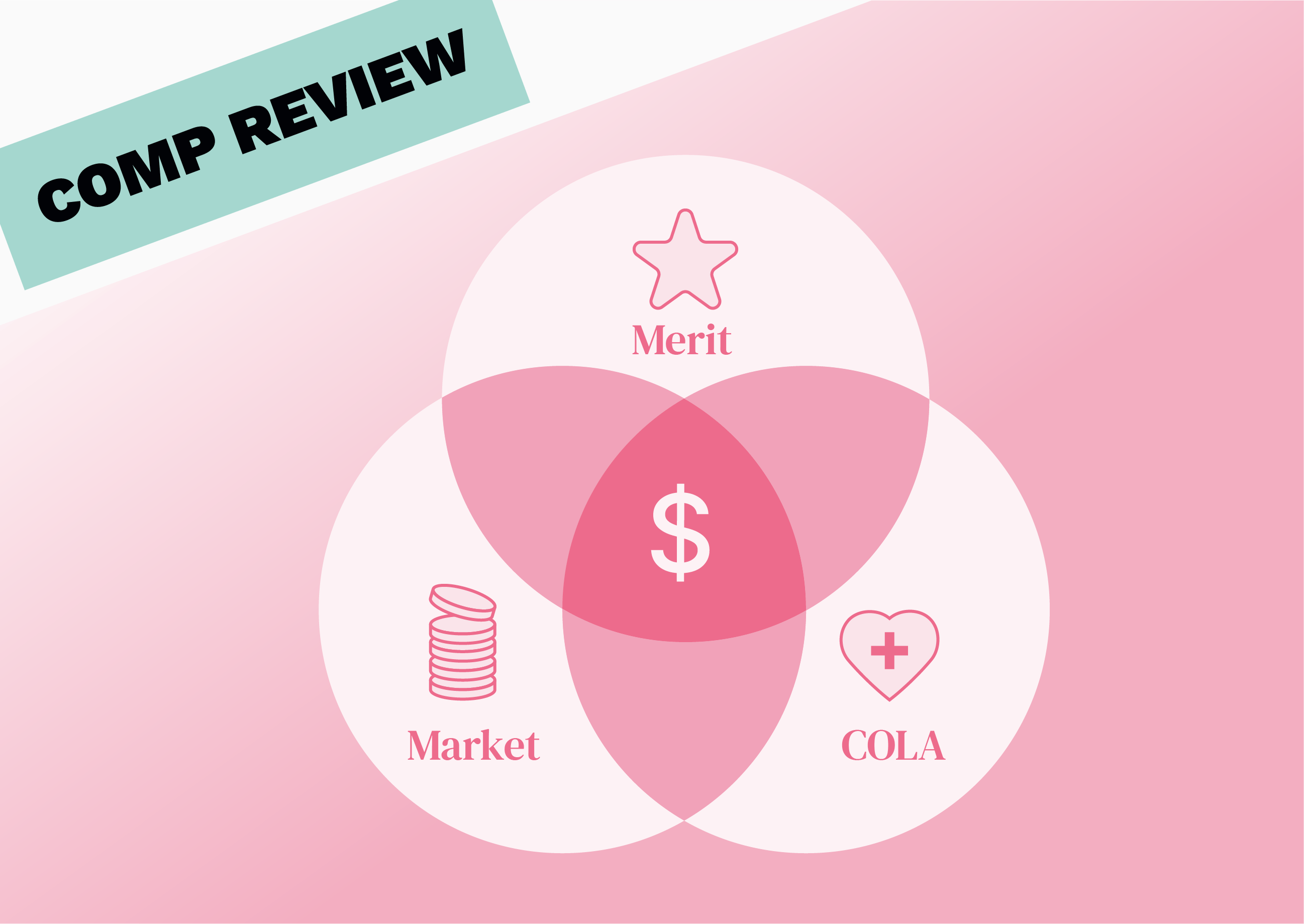

So, what are the different factors that go into your salary increase budget? It’s different for every company, of course — but here are four of the most common components to consider:

1. General increase

Many companies choose to allocate a part of their budget to a general increase in pay across the organisation. Or, they might provide this increase only to certain populations, such as the lowest-paid employees.

A general increase can be a fixed amount, but it’s more common to allocate a set percentage of basic salary — for example, 3%. This way, everyone gets the same effective increase on their existing salary.

A word of warning, though: although this method seems fair, it can perpetuate existing inequities. For example, if one employee is paid less than another employee in the same job due to salary compression, they’ll still be paid less after the increase.

For this reason, we recommend correcting any inequities first, and then awarding percentage increases based on the adjusted salary.

2. Merit and promotions

Recognising and rewarding employees for their work is vital for employee motivation and engagement. Because of this, many companies choose to allocate part of their salary increase budget to performance-based increases.

We can divide this part of the budget into two categories:

- Merit increases: This is when employees are rewarded with a pay rise for achieving a high level of performance. It doesn’t involve moving into a new role.

- Promotion increases: This is when employees are given a new role with new responsibilities and a new job title, which also entitles them to a higher salary.

3. Inflation

In recent years, many countries around the world have seen particularly high levels of inflation. This has contributed to the rising cost of living and left many employees struggling to make ends meet.

To compensate for this, some employers allocate part of their salary increase budget to specific, inflation-based increases. Essentially, this ensures that your employees’ salaries are still worth the same as they were a year ago — even if they’re not getting a raise.

There are a few different ways to do this. For example, some companies simply account for inflation when determining their general increase budget, while others define a separate budget to handle inflation increases. In either of these cases, employees might be given a smaller or larger increase depending on the rate of inflation in the country they work from.

Other companies choose to give employees a one-time ‘inflation bonus’, instead of increasing salaries. This allows you to help employees meet their living costs, without tying you into paying higher salaries once inflation rates have returned to normal.

In 2022–23, 56.7% of respondents who made inflation adjustments included it in their salary increases, while 40% tackled it through one-time bonuses.

4. Market adjustments

Many companies use market data to guide their salary decisions. This means looking at what other companies are paying their employees for the same roles, and basing your salaries on that data.

By looking at the spread of salaries on the market, you can decide where within that range you want to sit. For example, you might decide to pay your employees at the 50th percentile (or the market median).

The problem is that the market shifts over time. And if you’re not making market adjustments every time you conduct a compensation review, your employees’ salaries could fall below your desired positioning. That gives your employees a big incentive to look for another job since they’ll likely be able to earn more elsewhere.

Allocating a budget for market adjustments allows you to bring everyone on track and make sure you’re not underpaying your employees compared to your industry peers.

And, as we mentioned above, doing this before adjusting for other factors (performance, general increase, etc) allows you to avoid perpetuating any existing unfairness that might have crept into your salary structure.

What do salary increase budgets look like compared to last year?

At the end of 2023, we conducted a survey of 139 companies about their most recent and upcoming compensation reviews. We found that the average salary increase budget was:

- 6.2% of total payroll in 2022–23

- 4% of total payroll in 2023–24

As you can see, this shows that budgets are expected to decrease overall compared to last year. However, it’s worth noting that in 2022–23, many companies included a significant adjustment to account for high inflation. While this is still something companies are thinking about this salary review season, for many it’s less of a focus than it was in 2023–24.

Run smooth and effective compensation reviews with Figures

As you can see, running a compensation review is not a simple business. For most organisations, it means manually grappling with unwieldy, complicated Excel sheets.

Translation: hours wasted managing access rights, splitting then recombining sheets and handling endless back-and-forths with managers.

There is a better way. With Figures’ compensation review module, you can run effortless, compliant and easy compensation reviews in a fraction of the time, backed up by real-time market data and a robust, scalable salary band system.

Simply put, Figures allows you to streamline your compensation workflows by gathering all the information you need in one place, and recording every action as it happens. You can tailor the review cycle to your organisation’s needs, and get reliable, data-driven salary recommendations right within our platform.

Want to find out what else Figures can do? Sign up for a free demo to get started.

Psst! Want more compensation insights? Download our guide, Compensation Reviews in the Era of Pay Transparency for everything you need to know to run effective, transparent pay reviews.

Summarize this article with AI

No time to read it all? Get a clear, structured, and actionable summary in one click.