How To Handle Market Adjustments This Compensation Review Season

Every organisation should have an idea of its positioning in the market.

For very small, young businesses, this might be below the median — though they may be able to make this up to employees with benefits and perks. Other organisations choose to pay above the market median, which can help them to attract and retain top talent.

But here’s the problem: the market moves fast, and if you’re not regularly reevaluating your salaries, you could easily fall below your initial positioning. Eventually, this can lead to big problems with employee engagement, motivation and retention, as employees realise they’re no longer being paid what they’re worth.

In this article, we’ll discuss the importance of taking market adjustments into account when you run your next compensation review — plus some tips for doing it fairly and efficiently.

Psst! This post is an edited excerpt from our recent report, Compensation Reviews in the Era of Pay Transparency. In it, we share insights from our latest compensation review survey, plus tips on running compensation reviews that comply with the EU pay transparency directive. Download the full guide here!

The importance of including market adjustments in your compensation review process

If you’re not taking market data into account when you run your compensation reviews, you have no way of knowing if you’re paying your employees what they’re worth.

Not only does this send the wrong message to employees, it can also have a big impact on engagement and retention. After all, if your employees know they could get paid more elsewhere, why wouldn’t they?

Benchmarking salaries against the market every time you do a compensation review allows you to spot any employees whose salary has fallen below your desired positioning, and bring them up to where they should be. This keeps things fair and avoids issues like salary compression.

Of course, the opposite is also true: sometimes, people end up being paid above your desired positioning, for a variety of reasons. When you check their positioning at least once a year, you can slow down increases for anyone who’s currently paid above the market — conserving your budget for those who need an adjustment.

{{cta}}

How many companies take market adjustments into account?

In our 2023–24 survey, we asked respondents whether they were planning to take market adjustments into consideration in their next compensation review. We found that a third of employers were planning to take them into account, and a further 28.2% were considering it.

At Figures, we’re strong believers that you should incorporate market adjustments in your compensation review budget — and not just because comparing salaries to the market is our bread and butter.

Think about it: if you’re not adjusting salaries to bring them in line with the market, you don’t really know if your compensation is competitive. And if it’s not, you’ll soon feel the impact on employee engagement and retention.

How to incorporate market adjustments into your compensation review process: 3 options to consider

If you do want to include market adjustments as part of your compensation review process, there are few different ways to go about it:

- General increase to account for market changes. If you notice an overall change in the market, you might decide to give all employees a percentage increase to bring their salaries in line. This helps ensure you’re still paying everyone what they’re worth.

- Adjusting salary bands. Alternatively, you could shift your salary bands to bring them in line with the market. For example, if you increased a salary range by 5%, employees who stayed at the same level within that range (e.g. in the top, middle or bottom) would automatically get an increase.

- Individual adjustments based on market data for each role. Market standards for some roles move faster than others. That means that you could be underpaying some people compared to your peers, even if your salaries as a whole are aligned with the market. For this reason, some organisations choose to make individual adjustments to salaries for roles that have fallen below your desired positioning.

In our opinion, the last option is the fairest, as it’s the only way to ensure that everyone is getting paid (at least) the market rate for their role. But we do understand that adjusting everyone’s salary individually can be a lot of work — keep reading to find out how Figures can make that process easier.

{{cta}}

Balancing market adjustments with other increases

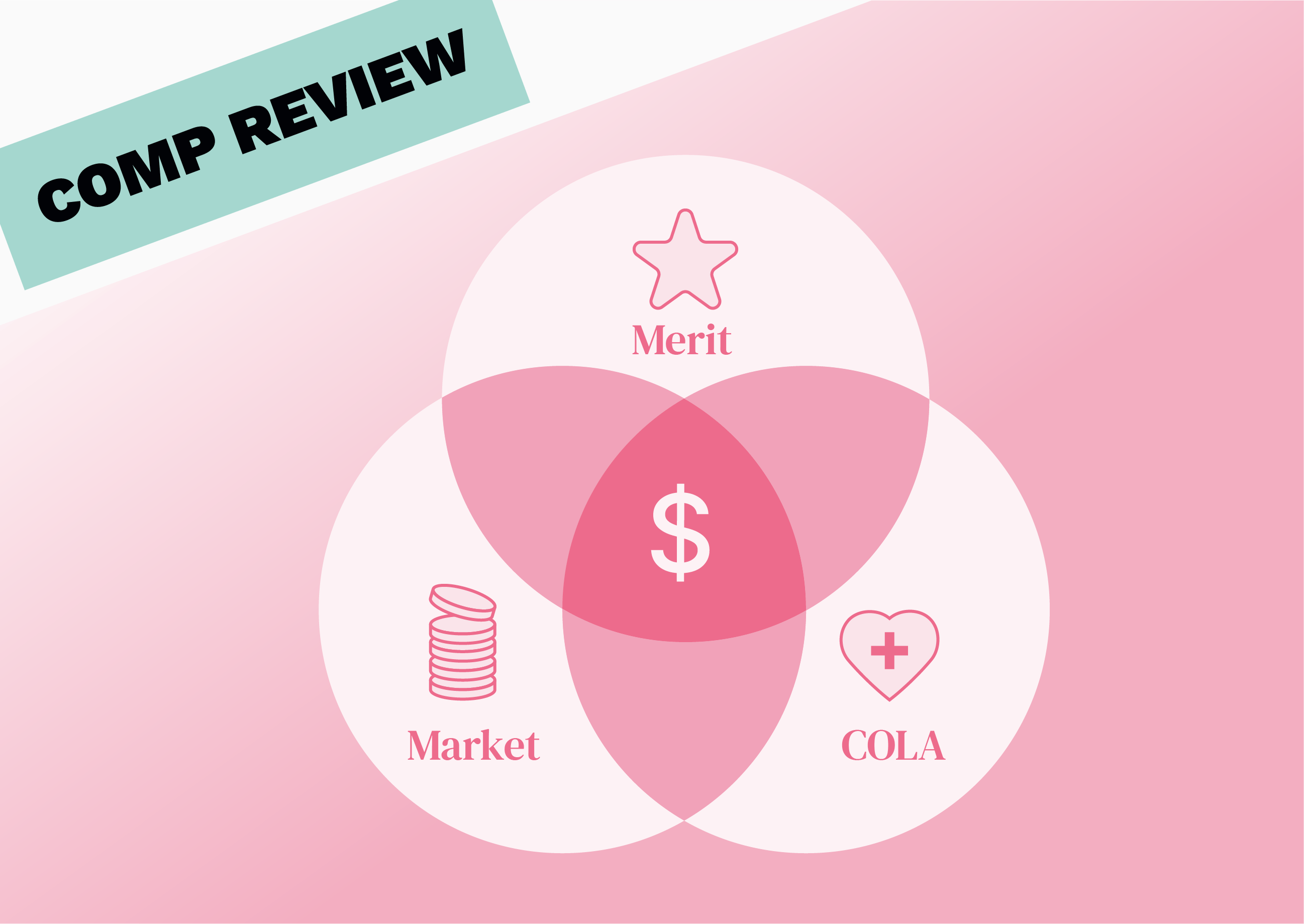

Market adjustments are just one part of your compensation review process. Depending on how things work at your organisation, you might also be planning to award a general increase across the business, performance based-increases or even an increase or one-time bonus to account for inflation.

If you’re planning to make market adjustments to bring your employees’ salaries in line, we’d recommend doing this before you award any other increases.

Here’s why: imagine you have two employees. One of them was hired a few months ago and negotiated a salary at the 50th percentile of the market. But the other was hired three years ago, and their salary has not been updated since — which means they’re currently being paid way below the market median.

If you give everyone a general increase of 3% without taking the market into account, the second employee will still be underpaid compared to the external market — making them a retention risk.

So, what should you do instead? Simple: take market adjustments into account first to bring everyone up to your desired positioning — and then use the rest of your budget for increases.

The easy way to run smooth and effective compensation reviews

Checking every one of your employee’s salaries against the market used to be a long, time-consuming process — but that was before Figures was around.

Our platform is backed up by a database of salary data from more than 1000 companies, and makes it easy to compare salaries to the market. Using Figures, you can quickly see where each employee is sitting in relation to the market in an accessible, visual format.

Figures also makes budget planning easier by automatically calculating how much you’ll need to spend to bring everyone up to your desired positioning. That means you’ll instantly know how much of your salary increase budget you need for market adjustments, and how much you have left for general increases, merit increases or promotions, for example.

Thanks to our new compensation review module, you can use Figures to run effortless compensation reviews, taking into account market adjustments, performance ratings and more — in a fraction of the time.

Want to find out more? Sign up for a free demo to get started.

Psst! Want more compensation insights? Download our guide, Compensation Reviews in the Era of Pay Transparency for everything you need to know to run effective, transparent pay reviews.

Summarize this article with AI

No time to read it all? Get a clear, structured, and actionable summary in one click.